How Venture Capital Companies and Investors Have Been Impacted?

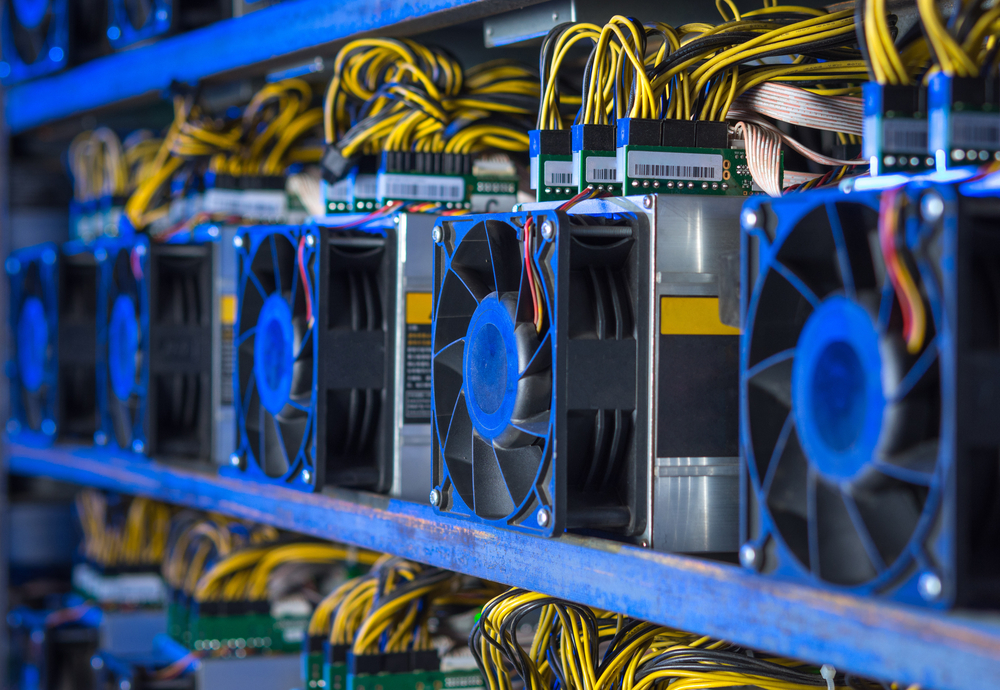

Blockchain is a revolutionary technology that has revolutionized many industries. Blockchain has revolutionized the financial sector, providing a rapid and secure way to move cash without the need for third-party intermediaries.

That aspect of decentralization has been motivating more people to use it in their daily tasks. Especially those who are just starting and need cash but don’t want to go through the tedious and antiquated procedures of gathering finances.

The Need for a Paradigm Shift

An industry like venture capital companies would then need to adopt Blockchain, combining the two beneficial features. Demand for capital for enterprises with long-term growth prospects is high.

Cryptocurrency exchanges might help Blockchain by releasing tokens for sale. This first step can revolutionise future technology investment.

This shift is why investors started investing in the first place. In spite of the danger, many interested in venture capital companies want to promote technical innovation and creativity.

By using an innovative solution like Blockchain, we can make investments more equal and within the regulations, maybe even increasing interest in this form of investment. Entrepreneurs and investors benefit from great growth and liquidity.

Tokens as Fresh Funding

Tokens are units that may be traded between persons and are vital in the crypto world. Security tokens are part of Blockchain’s digital tokenization and can be used to prove ownership of any asset. Tokenization makes illiquid commodities liquid and easy to trade.

Those that follow the existing approach, which Blockchain is supposed to disrupt, would lose out on many potential to boost earnings. It allows investors to retain tokens in portfolios and sell them anytime they choose, rather than waiting for a firm to succeed. The use of tokens allows for faster exits and more liquid investments.

The Solution to the Problem

Crowdnext is a VC business that focuses on giving novel investment possibilities. This latter can be useful for firms seeking investment but not wishing to launch an ICO, as well as investors seeking guidance.

That way, investors can make more informed decisions on whether or not to invest in a venture. Unlike traditional VC, an investor can readily exchange tokens before totally quitting.