Investors Hesitate to Sell BTC in Expectation of New Record

New research suggests that Bitcoin investors are causing a “supply shock” by amassing the cryptocurrency in the hope that the record-breaking price increase will continue.

According to Kraken Intelligence, the current all-time high price of bitcoin can be attributable to this occurrence, which warns that long-term holders are continuing to accumulate BTC rather than taking profits, thereby driving the price further higher.

Bitcoins in Circulation

There are only 21 million Bitcoins in circulation, and new ones are created through a process called mining. Approximately 18.5 million bitcoins have already been mined, but evidence suggests that more than a third of the current circulating supply is owned by long-term holders, implying that they have enormous influence over the market.

Despite the recent surge, Kraken Intelligence’s October 2021 Crypto On-Chain Digest finds that long-term holders have taken minimal benefit.

As a result, the largest market participants have grown more confident and choose to acquire even more… Long-term investors caused a supply shock last month, and it’s only gotten worse this month.”

Analysts at Kraken claim that recent price drops have been caused by the fact that “the bull run has not yet finished and new record highs can be expected before the end of 2021,” with on-chain metrics suggesting that the trend reversal is not yet complete. This supports the widely held belief that bitcoin will reach the six-figure mark by Christmas.

There has been a healthy amount of activity on the network, as well as long-term holding conviction, demand from institutional miners, and growing prices, according to the research.

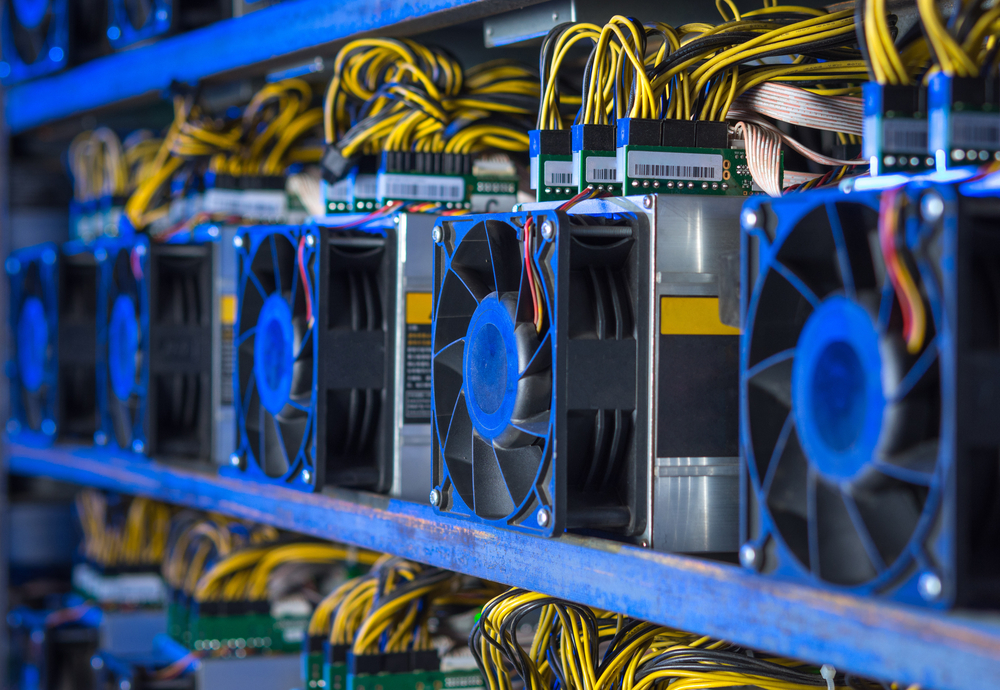

Bitcoin Mining Investment

As part of a proposed “No Sell November,” retail investors are urging individuals to “HODL” next month in order to keep the price of bitcoin even higher. This move is in addition to long-term holders and bitcoin miners refusing to sell their digital currency.

Both major and small players appear to be accumulating bitcoin according to Pete Humiston at Kraken Intelligence who told The Independent that the recent exodus of miners from China to the US has led to fresh investing in the area.

Bitcoin mining investment is up, which is a sign of resurgent confidence in the cryptoasset market, but we can also argue that a resilient mining industry strengthens the network’s overall resilience, in relation to the fundamental value proposition of bitcoin itself.